However, there are different types of cash books which can be more complicated. Again, the three column cash ledger diagram below shows only one side of the cashbook, the average american’s charitable donations in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book.

- Trade discount is a reduction in the list price of goods by a manufacturer/wholesaler to another business.

- It allows users to keep more detailed notes about their transactions.

- Cash books are deemed to be ledgers since all cash transactions made during a particular financial period are listed in the book in chronological order.

- Cash books are important because they allow businesses to track their finances in a detailed and organized way.

- In general ledger, two separate accounts are maintained for discount allowed and discount received.

Trial Balance

They serve as a general ledger and a journal requiring details about the funds’ source or use. Daily balances are easy to access and gauge, mistakes are detectable, and entries are kept up to date in cash books. Generally, cash books consist of two types – a general cash book and a petty cash book. But, there are three other types that companies use more often to handle cash dealings. A cash book contains receipts and payments of cash, credit sales, etc.

Just a Few More Details

In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account. The amount of the transaction is recorded in the final column. The petty cash book may be considered to be a fourth type of cash book. The financial balance of a real estate or personal ledger account that was carried over to the following accounting period is known as the Balance Carried Down (Bal c/d).

Posting Three Column Cash Book to Ledger Accounts

It acts as a journal or book of prime entry because all cash transactions are recorded in it as and when they take place. A passbook, on the other hand, is typically kept by the bank and provided to the customer. Passbooks will track all of the payments and receipts that have been made to and from the account. This includes a payment of cash made by the customer and payments made by the bank. The only exception is that a column is added in a three column cash book to account for bank-related transactions.

What are the types of Cash Books?

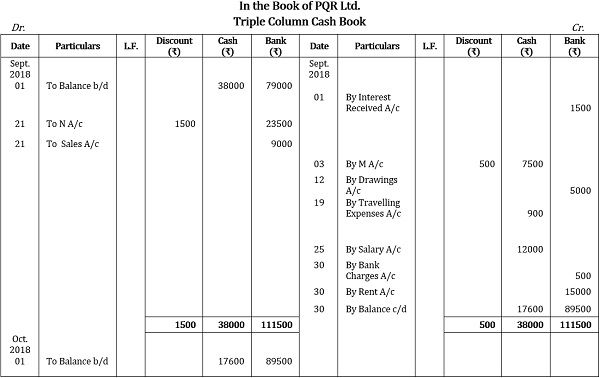

This is the table of transactions for Company X for the month of January 2022. This is the reason why discount columns are also provided in the cash book. On the bank’s side, the record is usually kept in the form of a personal account. It is maintained more or less along the same lines as a businessperson maintains their personal accounts for debtors and creditors. Similarly, when a check is issued to a supplier, an entry is made in the bank column on the credit side of the cash book. It also acts as a part of the ledger because it contains cash and bank accounts.

It also acts as part of the ledger because it has cash and bank accounts. The following example summarizes the whole explanation of triple column cash book given above. It has already been explained that when a cheque is received and not deposited into a bank on the same date, the amount will be recorded on the debit side of the cash book in the cash column. The opening balance of cash in hand and cash at the bank are recorded on the debit side in the cash and bank columns, respectively.

The two columns referred to in the name of this cashbook are the monetary amount of the cash receipt (Cash), and the monetary amount of the discount allowed (Discount) both highlighted in gray. The triple-column cash book has three columns and is the most complicated choice of the three. This version has other detailed information, such as purchase or sales discounts, in addition to the information found on the single- and double-column cash books. Users often use some form of accounting software to manage the triple-column cash book.

They allow businesses to keep track of payments and receipts in a detailed way. This can be used to make important decisions about the future of the business. Additionally, cash books can be used to create financial statements. These provide a detailed overview of the business’s financial health.